Click here for the data in excel

How to cite: Bonaparte, Yosef, 2019: "Geopolitical oil price risk index" J.P. Morgan Center for Commodities, Working papers

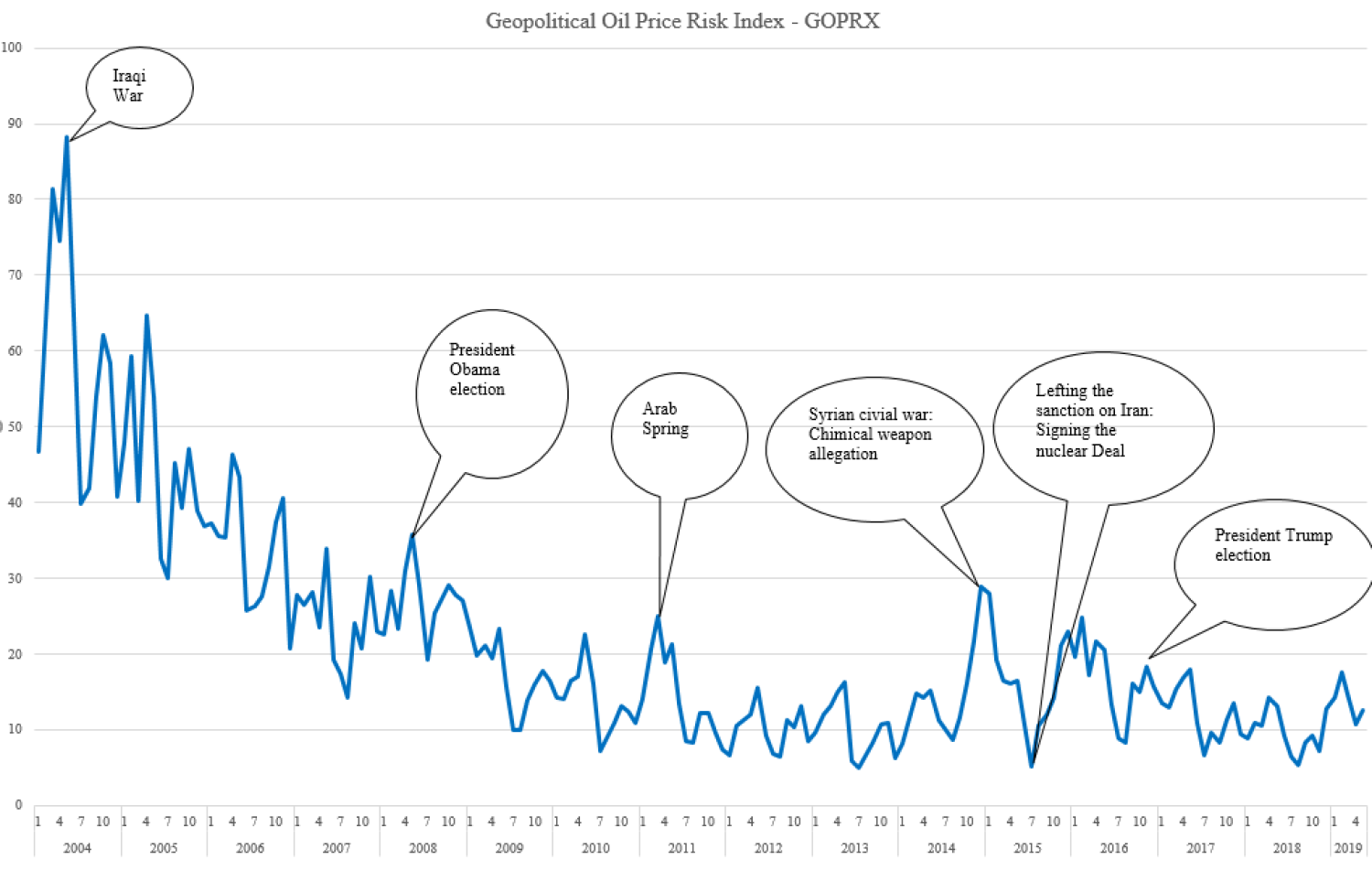

Geopolitical oil price risk index - GOPRX

About:

The geopolitical analyses reflects the world geopolitical impact on oil prices, volatility and supply.

Methodology:

We utilize data from Google Trends to track attention to several terms related to politics, uncertainty, oil price and supply. Several studies document that Google’s search engine is the leading search tool, used for 77.8% of searches among the different search engines on the web.[1] See Appendix A for academic support of our approach.

Following these insights, we use Google trends to track internet news search volume over time, using this as a proxy for investor news priorities. We use monthly data from Google Trends to obtain search volume for keyword phrases commonly associated with oil and politics. Having identified the most commonly used keyword phrases, we then use Google trends as our proxy for GOPRX. Specifically, to have a comprehensive information about GOPRX, we consider 17 different worldwide search text to measure the trends (see Appendix B). These 17 search texts are divided into 4 groups and reported in the table below. The first group related to sanction; the second group is titled as countries under political stress, and the third and fourth groups titled as political events and economic uncertainty.

We employ factorial analyses econometrics method, with some modification, to compose the monthly GOPRX. Thus, we define GOPRXt, as the GOPRX at time t. The factorial analyses provides the weighted average across the above determinants, hence,

We normalize the GOPRX, so it will be between 0 and 100, where 100 is the maximum geopolitical risk. Based on the above specifications, we then be able to evaluate our GOPRX overtime.

Figure and comovement:

We plot GOPRX for the period 4/2004 till 5/2019. For capturing the geopolitical oil impact, we find that the keyword phrases “sanction”, “Gulf war” and “Terrorism” are the most suitable onea. The time was during the Iraqi war 2004, another peak was post-election of President Trump 2016.

Furthermore, we find that GOPRX is highly correlated with OVX (Oil Volatility Index), with a correlation of 49.3%, and negatively correlated with oil supply with a correlation of -0.60%, which means the greater the GOPRX the lower the oil global supply. This findings motivate our main hypotheses in which there geopolitical influences oil supply and impact volatility.

Appendix A: academic support to use Google Trends

Studies by Vlastakis and Markellos (2012), Vozlyublennaia (2014) and Dimpfl and Jank (2016) suggest that Google searches function as a good proxy for retail investor news attention. Other papers demonstrate that search intensity varies over time; for example, Dzielinski (2012) shows that investors intensify their search in response to greater uncertainty; and Vozlyublennaia (2014) shows that more stock related Google searches are conducted when stock prices decline. The search intensity is also studied in economic psychology literature; Lemieux and Peterson (2011), and Abbas at al. (2013), provide empirical evidence that individuals intensify their search activity in response to greater price uncertainty.

Appendix B: search text keyword by group

To have a comprehensive information about GOPRX, we consider 17 different worldwide search text to measure the trends. These 18 search texts are divided into 4 groups and reported in table 7. The first group related to sanction; the second group is titled as countries under political stress, and the third and fourth groups titled as political events and economic uncertainty, respectively.

[1] For instance, see URL: https://www.netmarketshare.com/search-engine-market-share.aspx?qprid=4&qpcustomd=0

|

Number |

Group 1: Sanction |

Number |

Group 2: Countries Under Political Tensions |

Number |

Group 3: Political Events |

|

1 |

Oil Sanction |

1 |

Saudi Arabia Oil |

1 |

Middle Eastern War |

|

2 |

Iraq Sanction |

2 |

Venezuela Oil |

2 |

Israeli Arab Conflict |

|

3 |

Iran Sanction |

3 |

Libya Oil |

3 |

Gulf War |

|

4 |

Iraq Oil |

4 |

Terrorism |

||

|

5 |

Russia Oil |

5 |

Disruption Oil |

||

|

|

6 |

Syria Oil |

6 |

OPEC |

|

|

Number |

Group 4: Economic Unvertainty & Geography |

Number |

Group 5: US presidents and oil policy |

||

|

1 |

Oil Price Uncertainty |

1 |

Carter Oil |

||

|

2 |

Oil Uncertainty |

2 |

Reagan Oil |

||

|

3 |

Strait of Hormuz Oil |

3 |

Clinton Oil |

||

|

4 |

Gulf of Aden Oil |

4 |

Bush Oil |

||

|

5 |

Suez Canal Oil |

5 |

Obama Oil |

||

|

|

|

6 |

Trump Oil |